Credit cards are a useful tool for shoppers, as they allow them to buy things even if they don't have the money to do so. However, this tool also brings some dangers that need to be taken into account.

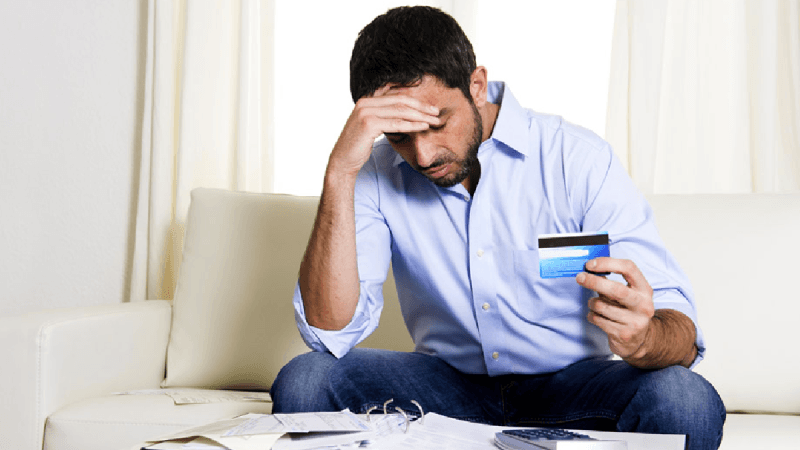

The main danger of credit cards is indebtedness. If used irresponsibly, it can be very easy to get into debt that you can't pay off. This will lead to higher and higher interest rates and a disastrous financial situation.

To avoid these dangers, it is important for users to take precautions and use credit cards responsibly. This means not spending more than you can afford and making sure you pay your bill on time each month to avoid excessive interest.

Definition of credit cards

A credit card is a form of short-term loan offered by banks and other financial institutions. This card can be used to purchase products and services, make payments to other vendors, withdraw cash, etc. When using it, the borrower will receive a monthly bill that must be paid within a certain period of time.

Credit cards also have some special features, such as the possibility of buying in installments without paying interest for a certain period of time. This means that the user will be able to take advantage of merchants' offers and make larger purchases without worrying about immediate payment.

However, there are also dangers associated with credit cards if they are not used correctly. The main danger is excessive indebtedness, as many people do not always take into account the interest and expenses associated with the use of the card. Therefore, it is important to establish a budget and ensure that bills are paid on time to avoid potential financial problems.

Benefits of credit cards

Having a credit card has many benefits, such as increased spending awareness and a boost to your finances. In addition, there are many credit cards that offer their users rewards for using the card, such as points, discounts and special offers. These rewards are a great way to get additional benefits when using a credit card.

Credit cards also offer security for shoppers. Most cards have insurance and warranties that provide protection for users if their items purchased with the card do not work or are lost. This means that shoppers are protected if something goes wrong with their purchase, and they won't have to bear all the costs themselves.

Dangers associated with credit cards

Credit cards can be a useful tool for improving the quality of life, but they also carry some risks. The biggest dangers associated with credit cards include high interest costs, increased indebtedness, the possibility of fraud, and vulnerability to administrative errors.

To avoid these dangers, it is important to use your credit card responsibly. This means only spending what you can afford to pay off each month, reading the detailed terms of the agreement, and always being on the lookout for back doors or unsolicited service charges. While the dangers associated with credit cards are significant, they can be avoided by taking steps to use them responsibly.

Tips for Avoiding Credit Card Hazards

Tip 1: Never share your personal data or credit card information, especially online. Always check terms and conditions and make sure websites are secure before making a purchase.

Tip 2: Set limits for your monthly credit card spending. Setting a budget and a limit on how much you can spend with a credit card each month is an effective way to avoid overspending.

Tip 3: Keep detailed, up-to-date records of all your credit card activity. Always review statements periodically to check for fraudulent charges or errors in charges.