Debt can be a common problem for many people, especially in tough economic times. But having debt doesn't have to be a constant part of your financial life. With a few changes in your spending and saving habits, you can avoid debt accumulation and live without financial worries.

Tips for good financial management

To avoid debt and live without financial worries, it is important to manage our finances well. Some tips that can help us in this process are:

- Develop a budget: It is essential to know our income and expenses in order to make sound financial decisions.

- Save part of your income: Allocate part of your income to an emergency fund or savings for long-term goals.

- Avoid unnecessary indebtedness: Do not acquire debts that you cannot pay and try to reduce your expenses to have more capacity to pay.

- Differentiate between needs and wants: Learn to differentiate between what you need and what you want, and prioritize your needs first.

- Search for the best price: Before making a purchase, look for different options and compare prices to get the best deal.

- Keep a good record of your transactions: Keeping an accurate record of your transactions will allow you to have better control over your money.

Following these tips will not only help you avoid debt but also help you improve your financial quality of life and reach your financial goals more easily. Remember the importance of good financial management in making the right decisions that affect our financial future.

Developing a budget and following up on it

A fundamental tool to avoid debt and live without financial worries is the elaboration of a personal budget. A budget is a plan of expenses and income that will allow you to know exactly what your monthly income, fixed and variable expenses, savings and debts are.

To prepare a budget you need to write down all your monthly income and the expenses that you regularly incur such as rent, mortgage, food, clothes, transportation, etc. You should also include variable expenses such as eating out or unplanned purchases. This way you will have a clear picture of what you are spending your money on.

Once you have this information, you will be able to see in which areas you can save or reduce expenses in order to meet all your financial obligations and have money to save or invest.

It is not enough to make a budget, it is also important to keep track of it to see if you are meeting your plans. To do this you can use a spreadsheet or a specialized application that allows you to record all the movements you make in your bank account and update the budget accordingly. This way you will be able to quickly identify if there are deviations or imbalances in your personal finances.

Tracking your budget will also help you identify which financial habits you need to change in order to achieve a more stable financial life. You may need to reduce some expenses, look for ways to increase your income or implement regular savings habits.

In short, budgeting and budget tracking is essential to avoid debt and live without financial worries. With this tool you will be able to make more informed decisions about how to manage your money and design a long-term financial plan that will allow you to achieve your personal goals.

Saving and long-term planning

If you want to live without financial worries, it is important to develop a long-term plan. This means setting financial goals and working toward them consistently. The following are some suggestions to help you save and plan for the future:

- Set specific financial goals: Decide what you want to achieve financially and set specific goals to get there.

- Calculate your expenses: Keep track of your monthly expenses and make a realistic budget.

- Save a fixed amount each month: Save a fixed amount of your salary each month, even if it is only a small amount.

- Invest in a retirement account: Contribute regularly to a retirement account to make sure you have enough money to retire comfortably.

- Invest in mutual funds or bonds: Consider investing your money in mutual funds or bonds to earn higher returns than those offered by a regular savings account.

- Avoid unnecessary debt: If you need to borrow money, make sure you can repay the loan on time and not take on more debt than necessary.

Living a frugal lifestyle and being disciplined with your finances will help you maintain financial stability and avoid falling into unnecessary debt. Plan ahead and maintain financial discipline, and you can achieve your long-term financial goals without worry.

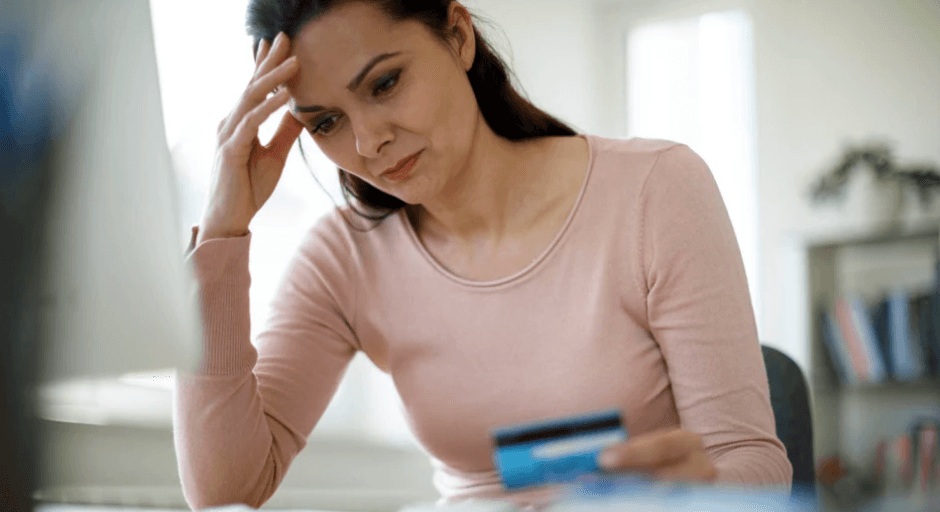

Responsible use of credit cards and loans

To avoid falling into debt and financial worries, it is essential to use credit cards and loans responsibly. Some important tips are:

- Set a monthly spending limit. It is important to know how much money you can spend with a credit card or loan so as not to exceed it and accumulate interest.

- Do not use credit for unnecessary expenses. The credit card or loan should be used only for important and urgent expenses, not to buy whims.

- Always pay more than the minimum. If a credit card is used, it is essential to always pay more than the minimum to avoid accumulating high interest rates.

- Do not have several credit cards. The ideal is to have only one card and to control its use.

- Do not borrow unnecessarily. Taking out a loan implies paying interest and commissions, so it is important to evaluate whether it is really necessary before doing so.

If you follow these tips, you can make responsible use of credit cards and loans without falling into the temptation of excessive indebtedness.

How to get out of debt once you have already accumulated debt

If you are already in a situation where you have one or more accumulated debts, don't worry, you can still get out of them. Here are some tips:

- Create a budget: it is important that you know exactly how much money you have and how much you owe. Make a list of all your income and expenses so you can identify where you can reduce your spending.

- Pay what you owe: focus on paying the debts that generate the most interest first. If you have several debts, prioritize those with high interest rates to prevent them from continuing to accumulate.

- Don't take on more debt: While you are paying off your existing debts, try to avoid taking on new ones. This will only prolong your complicated financial situation.

- Negotiate with your creditors: if you cannot pay all your debts in full, contact your creditors and negotiate payment options or even discounts. It is better to have an agreed plan with them than no payment at all.

- Consider consolidating your debts: if you have several debts with different interest rates, consider consolidating them into one loan with a lower rate. This will simplify your payments and reduce interest.

Getting out of debt can be a long and difficult process, but if you follow these tips you can overcome this complicated financial situation. Remember to always stay focused on your goal and have financial discipline to avoid falling back into this situation.

Negotiating with creditors

If you are already in a situation of indebtedness, it is important that you do not ignore it and take steps to solve it. Negotiating with creditors can be a good option to reduce your debt and avoid paying high interest rates.

To begin negotiating, it is advisable to evaluate your financial situation and know how much you can afford to pay your debts each month. With this information at hand, you will be able to present a realistic proposal to your creditors.

It is important to keep in mind that negotiation does not guarantee a 100% reduction of your debt, but you can achieve discounts on interest and payment terms.

Do not be afraid to talk to your creditors and expose your situation. It is better to look for solutions together than to let the debts continue to grow and create a bigger problem.

Debt Consolidation

Debt consolidation is a process by which all debts are rolled into one, usually with a lower interest rate. This can help simplify payments and reduce the overall cost of debt.

There are several ways to consolidate debts, such as through personal loans, balance transfer credit cards or home mortgages. It is important to evaluate each option carefully and understand the terms and conditions before deciding which is best for your financial situation.

However, debt consolidation is not always the best solution for everyone. It is important to address the underlying causes of debt accumulation and develop a sound long-term financial plan to avoid future financial difficulties.

Selling unneeded assets

Another way to avoid debt is to sell assets that are not needed. Many people have items in their homes that they no longer use and could sell for extra cash. For example, old cell phones, appliances, furniture, clothing and accessories. Selling these items can help generate income and reduce the amount of debt.

Also, if you have property or vehicles that you don't use often, you may want to consider selling them. Not only will this provide you with additional income, but it will also reduce the cost of maintenance and insurance.