If you are thinking of applying for a loan or credit, it is important that you have a good credit history in order to get the best conditions. In this article we will explain how to improve your credit history and what actions you should take to get the best financing options.

What is credit history?

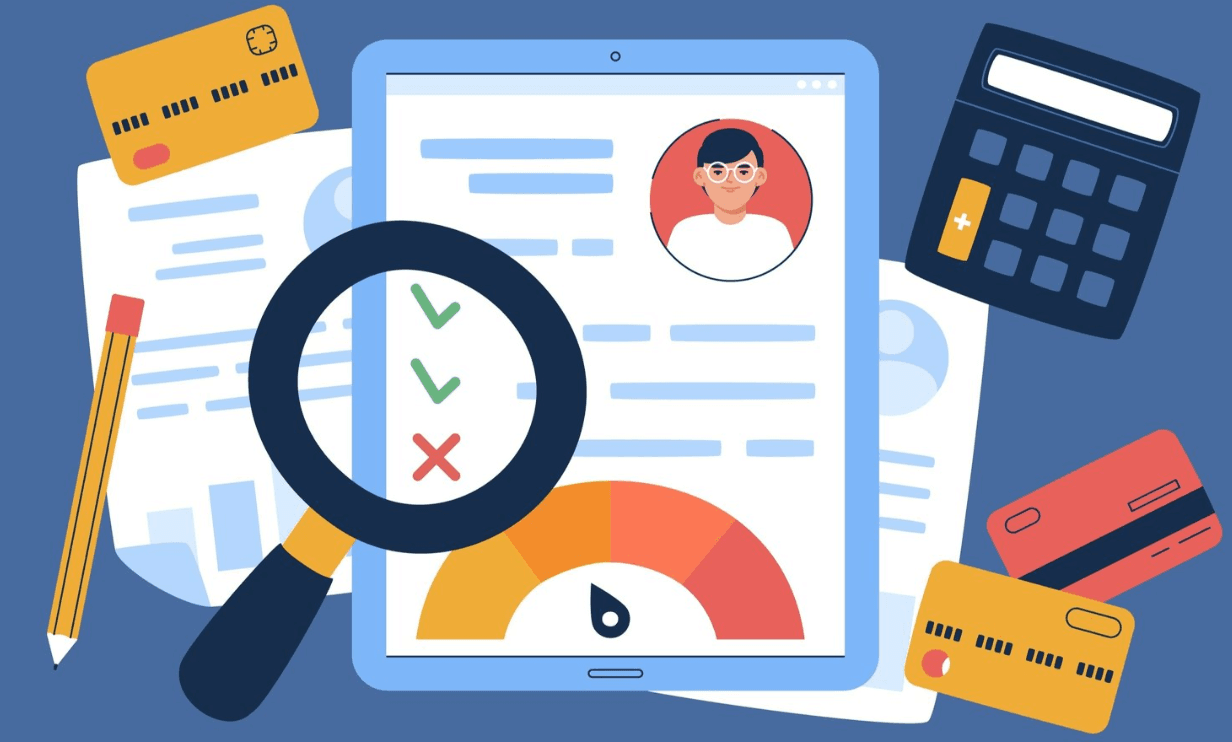

Credit history is a record of all the debts you have had and how you have paid them. This information is used by financial institutions to evaluate your ability to pay your debts in the future. A good credit history can help you obtain loans and credit with better terms, while a negative credit history can affect your chances of obtaining financing.

Why is it important to have a good credit history?

Having a good credit history is essential to obtain better terms on loans and credit. When you apply for a loan, the financial institution reviews your credit history to determine whether you are a reliable customer or not.

A good credit history means that you have paid your debts on time and have no outstanding debts. This gives a positive signal to the lender that you are someone who can pay back the money borrowed within the agreed time frame.

If you have a poor credit history, lenders may give you loans with higher interest rates or even deny your application. Having a good credit history can also help you get better terms on other financial matters, such as services like insurance or cell phone plans. In short, having a good credit history is key to accessing better terms on loans and credit, as well as improving your overall financial profile.

How is credit history calculated?

The credit history is calculated based on the information that financial institutions record about your credits and loans.

Among the data considered for this calculation are:

- Number of loans you have applied for.

- Number of loans you have paid on time.

- Number of loans you have not paid or have paid late.

- Loan amounts and terms.

- Your income and expense ratio.

With this information, financial institutions can assign you a score or credit risk score. The higher your score, the more likely you are to be granted better conditions on loans and credit.

Therefore, it is important that you try to keep your payments up to date and learn how to improve your credit history. This way you will be able to access better conditions in your financial operations.

How can I improve my credit history?

Improving your credit history can be a long process and requires financial discipline and organization. Here are some tips on how to do it:

- Pay your debts on time: Paying your debts on time is one of the most important factors to improve your credit history.

- Reduce your debt levels: Try to keep your debt levels below 30% of your total credit limit.

- Don't close your old accounts: Old accounts with a good history can be beneficial to your credit score.

- Add new accounts carefully: Adding new accounts too quickly can damage your credit history. Make sure you can handle them before opening new lines of credit.

- Keep an eye on your credit report: Regularly check your credit report to make sure it's free of errors and fraud.

Follow these tips and you will see a gradual improvement in your credit history. Remember that financial discipline is key to maintaining a good credit score over the long term.

Pay your debts on time

One of the most important factors in improving your credit history is to pay all your debts on time. This includes paying credit cards, personal loans, mortgages and any other financial obligations you have.

If you are having difficulty paying on time, consider setting a budget and reducing your expenses. You can also negotiate with your creditors to set up payment plans that fit your budget. Remember that late payments can negatively affect your credit score and make it difficult to access better terms on loans and credit in the future.

Not using your full credit limit

One of the most common mistakes made when having a credit card is to use all of your available limit. This can negatively affect your credit history and make it more difficult to obtain loans or credit in the future.

Ideally, use only a portion of your credit limit and pay your balance on time. By showing responsibility and discipline in the use of your credit cards, you will be building a solid credit history and improving your long-term financial options.

Diversify your credit sources

It is important not to depend on a single source of credit, because if that source closes or becomes more demanding, you could be left without access to financing. Therefore, it is advisable to look for different options and evaluate which are the best for you.

A good way to diversify your sources of credit is to apply for loans or lines of credit from different financial institutions, such as banks, credit unions and online lenders. You can also consider getting credit cards from different issuers.

Remember that while it is important to have access to financing, it is also crucial to be responsible with the use of it and pay your debts on time. This way you can improve your credit history and have better options in the future.

Do not close old credit cards

Closing old credit cards may seem like a good idea if you are not using them, but this can negatively affect your credit history. This is because the amount of available credit is reduced and the percentage of credit utilization increases.

Ideally, keep old credit cards and use them for small purchases, such as gasoline. This way, you demonstrate a good credit history and increase the total amount of available credit.

Conclusion

In summary, improving your credit history is fundamental to obtain better conditions on loans and credit, which will allow you to have access to financing at key moments in your life. To achieve this, you should start by knowing your current debt situation, making a budget and avoiding unnecessary indebtedness. In addition, it is important to pay your debts on time and maintain a good relationship with your creditors.

Remember that improving your credit history is not something that can be achieved overnight; it requires patience and commitment on your part. But if you follow these tips and maintain a good financial behavior, you will see how little by little your credit history will improve and you will have access to better conditions in loans and credits. Don't wait any longer to start improving your credit history, take action right now!