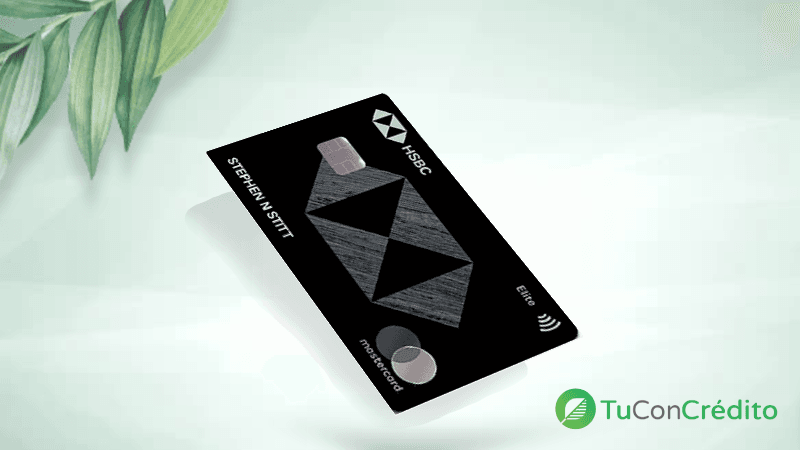

Almost all major card issuers now offer a premium travel card and HSBC is no exception. The HSBC Elite credit card offers a little bit of everything; travel insurance, airline tickets and ride credits, lounge access and hotel discounts when you book through the Agoda or Expedia portals.

| Positive points | Negative points |

|---|---|

| No foreign transaction fee | High annual fee of $395 |

| 3x points on travel purchases | High regular APR and penalty APR |

The main problem is that cardholders must have (and maintain) an HSBC Premier Checking account to be a cardholder. Checking requires a significant banking relationship to waive the monthly maintenance fees.

You will need to have $5,000 in monthly direct deposits, $75,000 in total deposits and investments, or a mortgage originating at $500,000 or more to qualify.

| Benefits | |

|---|---|

|

Points

|

Earn unlimited points that do not expire |

|

Advantages

|

Robust travel benefits and advantages |

|

Insurance

|

Travel Insurance |

|

Protections

|

Daily Protections |

Travel Insurance

Coverage for travel accidents, trip cancellation, hotel theft, lost or delayed luggage, and secondary rental car collision damage waiver insurance. Click the button below and apply for your card.

I Want My CardEarning Rewards

Cardholders can start earning through a one-time welcome bonus of 50,000 bonus points worth $750 on airline tickets, when booked online through HSBC Rewards, after spending $4,000 within the first 3 months of account opening.

Daily Protections

Cardholders receive cell phone insurance, price protection, extended warranty, and purchase guarantee on qualifying purchases. Click the button below and apply for your card.

I Want My Card