Tips to control your expenses

It is important to set a budget so you don't overspend.

This means creating a list of expenses and deciding how much you can spend in each area of the budget.

This list should be updated periodically to account for changes in prices and needs.

Using credit cards can be a good way to control spending, but it is important not to go overboard.

Set limits and monitor the amount in your account to avoid excessive fees and interest.

Try to pay your balance in full each month to avoid extra payments.

Organize your finances

The first recommendation is to have a clear view of all your finances. It is important to keep track of all your income, expenses and assets.

This will allow you to see exactly what is happening with your money. You should also identify what your short, medium and long-term financial goals are.

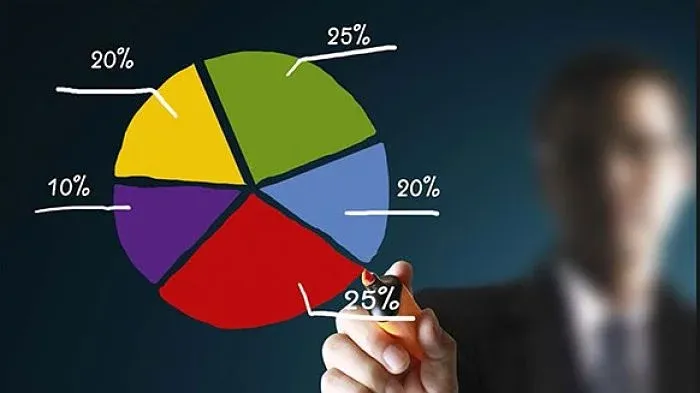

It is important to establish a realistic budget that is easy to follow. Divide your expenses into categories such as food, clothing and housing.

A good tip for organizing your finances is to save and invest regularly. Set realistic financial goals and establish a timetable for achieving them.

Establish a budget

Establishing a budget that fits your needs is essential to controlling your spending.

This will allow you to determine how much money you can allocate to each area of your life, and you can also track your spending to see when you go off your plan.

This way, you are less likely to overlook something and end up overspending.

Following a budget doesn't mean you have to change all of your shopping habits, but it does mean you'll need to pay attention to every detail.

Reduce unnecessary expenses

1.To do this, you have to review your expenses and make a list of things you really need and things you can do without.

2. This way, you will be able to save money on those expenses that are not essential and you will surely notice the difference in your finances.

3. In addition, it is advisable to compare prices before buying anything to make sure you get the best possible price and avoid unnecessary expenses as much as possible.

4. It is important to make sure you keep an emergency fund for any unforeseen events.

This will avoid having to resort to credit cards or other loans in case of unexpected loss.

Aim to save 10-20% of your monthly income is a good goal to have a significant amount in reserve.

Set short- and long-term goals

Setting goals will help you stay focused and give you a direction to follow. Set realistic goals so you don't get frustrated when you don't achieve them.

Keep in mind your long-term financial plans as well. For example, buying a house.

Setting these goals will help you see the big picture and better plan your money.

Stay informed about the financial market

It is important to stay informed about the financial market to make sure you are making the best decisions for your finances.

It is advisable to follow financial market news more closely to understand how it affects your spending and financial decisions.

In addition, you should understand the macroeconomic factors that influence financial asset prices to know if it is a good time to invest or not.

Be realistic with your savings goals

You won't be able to save more money if you don't set realistic goals.

Setting your goals too high can discourage you and make you give up on the effort.

Set a realistic goal that you can reach now to motivate you to save more.

Develop a detailed budget

Use a detailed budget to keep accurate track of each item of your spending.

Be very careful with your spending and constantly review your budget to see how close you are to your savings goal.

Set priorities and make small changes. Setting priorities will allow you to focus your energy on the most important things.

Identify expenses that are holding you back from reaching your goals and look for simple ways to reduce them, such as buying items for less money or using coupons.